The Cost Factors: Florida’s Tri-County Homeowners Insurance

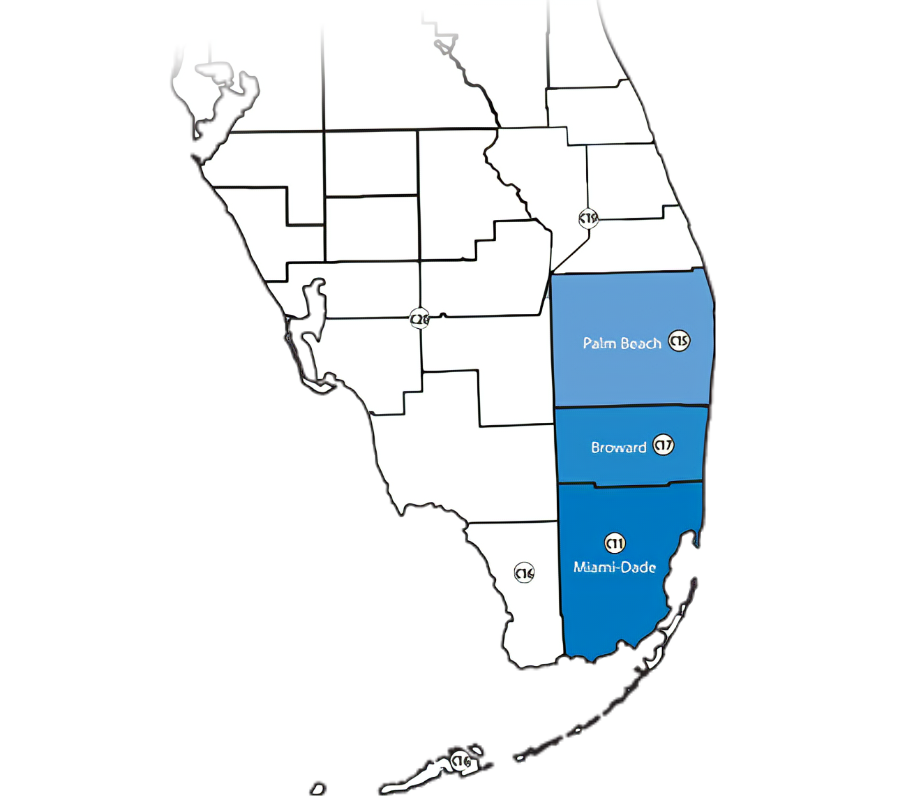

Homeowners insurance is a vital investment for Florida’s Tri-County area residents, encompassing Miami-Dade, Broward, and Palm Beach counties. This region has unique challenges, including the high risk of natural disasters such as hurricanes and flooding. As a result, homeowners insurance rates in this area tend to be higher compared to other parts of the country. Understanding the factors contributing to these costs is crucial for residents looking to protect their homes and make informed choices about their insurance coverage.

Understanding Florida’s Tri-County homeowners insurance

Homeowners insurance provides financial protection for homeowners in the event of damage to their property or personal belongings. This coverage is critical in Florida due to the state’s vulnerability to natural disasters. Policies typically cover a range of perils, including windstorms, lightning, fire, and theft. However, it’s important to note that flood insurance is typically not included in standard homeowners insurance policies and must be purchased separately.

Factors Affecting Homeowners Insurance Costs in Florida’s Tri-County Region

Several factors influence the cost of homeowners insurance in any given area. These include the age and condition of the home, the location, the property’s value, and the homeowner’s claims history. Additionally, factors specific to Florida include the proximity to the coast and the risk of hurricanes and flooding. Insurance companies also consider the home’s construction type, safety features like hurricane shutters or impact-resistant windows, and the distance to the nearest fire station. All of these factors affect the home’s risk profile, which impacts the cost of insurance coverage.

Conclusion

Living in Florida’s Tri-County area presents homeowners with unique insurance challenges due to the high risk of natural disasters. Various elements influence the cost factors associated with homeowners insurance in this region. Moreover, these include the home’s age, location, value, and the homeowner’s claims history. Additionally, the proximity to the coast and the risk of hurricanes and flooding play significant roles in determining insurance costs. However, homeowners in this region can take specific steps to mitigate these costs, such as fortifying their homes with hurricane-resistant features and seeking discounts offered by insurance companies. Tri-County homeowners can make informed decisions and protect their properties effectively by understanding these cost factors and implementing strategies to reduce risks.